Strategic decision-making is an integral part of running a business. And yet, often, a company’s decisions do not reflect the strategy laid out by those in charge. In some cases, a firm that wants to take risks, and be highly entrepreneurial and innovative, will note that its managers nevertheless make restrictive, conservative decisions. On the other hand, a firm that has not explicitly decided to place big bets may make risky choices, such as a large capital investment or the launch a new line of products. Professor Olivier Sibony asks, “Why is there often a disconnect between what a company wants to achieve, and the decisions it makes to achieve it?”

Why is there often a disconnect between what a company wants to achieve, and the decisions it makes to achieve it?

To answer this question and provide solutions for business executives, Sibony et al. explored how behavioural strategy can help ensure the right business decisions are made. Noting that cognitive and behavioural biases often play a part in decisions that go against company strategy, the researchers define guidelines for designing decision-making processes that promote greater alignment with an organization’s overall business strategy.

Daily decisions drive the strategic direction of companies

Some everyday decisions have, in aggregate, a big impact on how a business functions. Such decisions include, for example, a consumer goods firm deciding which products to launch or a pharmaceutical firm managing its drug development pipeline. Sibony et al. note that these decisions are not always considered as part of a company’s overall strategic plan, but viewed, instead, as mere functional routines.

However, these decisions shape the future of the company. “These processes make up the core strategic decision architecture of a firm,” he says. “Some processes are common to most companies, such as budget or investment processes. Others are specific. Decisions made during these processes can have a knock-on effect to other strategic processes and drive company strategy in a particular direction.”

Designing core strategic decision-making processes to reduce bias

As such, it is the decisions made during these core strategic processes that affect a company’s ability to achieve its goals. If a company’s core strategic processes can be identified and designed more intentionally, therefore, Sibony argues that it can minimise the risk of behavioural and cognitive biases. “Decision routines are not set in stone. Companies can and should design them actively to minimize bias and produce the outcomes they hope for,” he explains.

3 types of decision processes to redesign: investment, resource allocation and blue sky

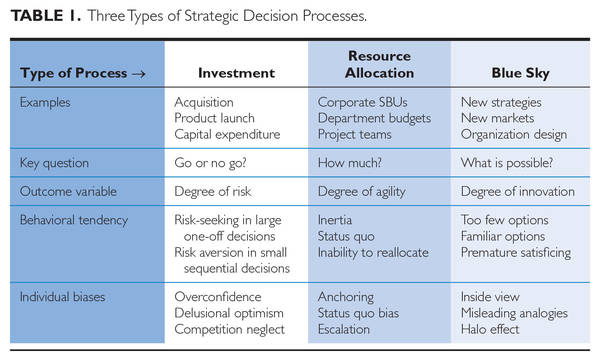

Sibony et al. identify 3 types of strategic decision-making processes and the biases that tend to emerge in each unless you design against them:

1. Investment: In general, investment processes have a tendency to result in too much risk-taking on big decisions and not enough on small ones. Effective design of investment processes addresses these two contradictory biases and results in more or less conservatism where relevant.

2. Resource allocation: When it comes to the allocation of resources, such as budget or personnel, the natural tendency is to replicate past allocations – for instance, by continuing to over-resource declining businesses. Rather than making marginal adjustments to existing allocations, processes should be designed to start as much as possible from a blank slate.

3. Blue sky: To achieve breakthroughs, companies must foster creativity. But not all companies pursue radical innovation. Depending on the degree of innovation they want, the decision processes to achieve it will look very different.

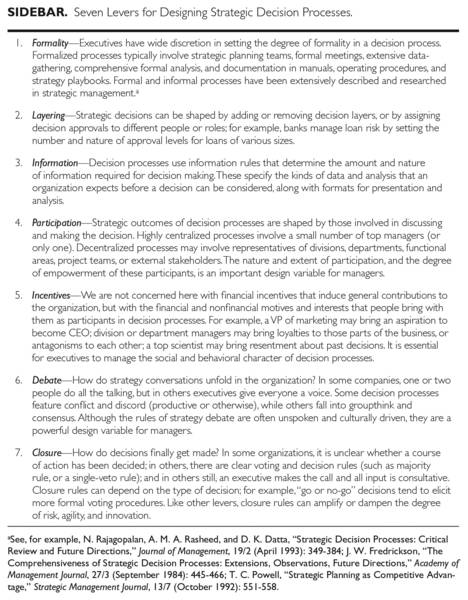

7 design levers

Sibony et al. outline 7 levers that can be considered in designing strategic decision-making processes: formality; layering; information; participation; incentives; debate; and closure. “All 7 levers can be used to fine-tune a given decision process and achieve a company’s required level of risk taking, agility and innovation.”