Do investors value sustainability index inclusion?

Executive Factsheet

Changes in sustainability index inclusion (i.e., becoming incorporated in high visibility sustainability indices such as the Dow Jones Sustainability Index or, on the contrary, leaving them) generate only limited stock market reactions. However, this does not mean that companies do not benefit from to sustainability index inclusion. In fact, becoming listed in such indices attracts more attention from financial analysts. Furthermore, remaining listed in them increases the percentage of equity held by long-term investors over time. This suggests that investors value activities related to Corporate Social Responsibility.

Download the PDF: Do investors value sustainability index inclusion?

Investors and responsible investing (1)

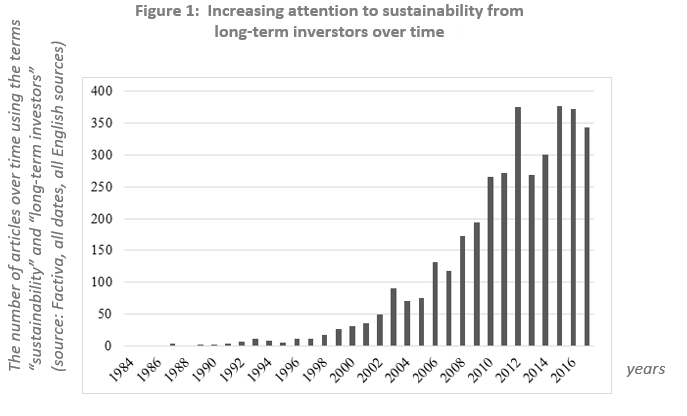

An increasing number of investors pay attention to sustainability issues, as reflected in the growing number of articles on the matter (Figure 1). Since 2006, over 2,000 signatories with more than 80 US$ trillion assets under management have signed the UN Principles for Responsible Investment (PRI) and joined one of the most prominent networks of responsible investors in order to demonstrate their commitment to environmental, social, and governance factors in investment decisions.*

*Source: United Nations Principles for Responsible Investment website.

The role of sustainability indices (1)(2)

Indices such as the Dow Jones Sustainability Indices (DJSI) help market and non-market actors evaluate the performance of the world’s leading publicly-traded companies based on social, environmental, and financial criteria. Since these indices are publicly available and companies have to compete to be listed, inclusion in sustainability indices sends discernible signals to the market. Each year, firms invest considerable amounts in sustainability and CSR activities (e.g., by setting up information systems or paying external assurance providers to audit their CSR reports) to be ranked among the top sustainability players within an industry - but is it worth it?

Does sustainability index inclusion pay off? (1)

While previous results remain inconclusive, recent large-scale longitudinal event studies show that changes in sustainability index inclusion generate only limited stock market reactions: being added to, or getting deleted from, the DJSI barely has an effect on corporate stock prices or trading volumes. Yet, this does not mean that sustainability index inclusion does not matter. In fact, these studies highlight that firms benefit from being included in the DJSI:

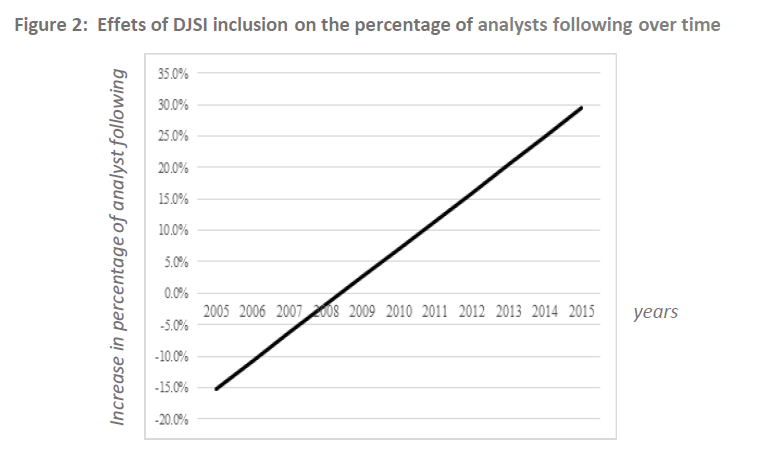

Being included in the DJSI attracts increased attention from financial analysts (Figure 2). In 2005, companies added to the DJSI had 15% less financial analysts following them (equivalent to about 2 financial analysts) compared to firms with a similar level of CSR. In 2015, companies added to the DJSI had on average 29% more analysts following them (equivalent to about 5 financial analysts).

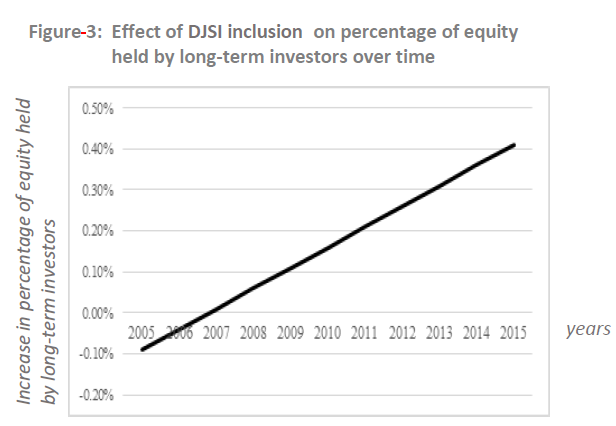

Remaining in the DJSI increases the percentage of equity held by long-term investors (Figure 3). In 2005, companies that continued to be listed in the DJSI had 0.1% less equity held by long-term investors. In 2015, firms that remained listed in the DJSI had on average 0.4% more equity, i.e., approximately $112 million of market value, held by long-term investors relative to CSR-equivalent firms.

In view of the growing number of sustainability equity indices (e.g., ESG indices in the MSCI, Russel, and DJSI families), the frequency, and thus the economic significance of these effects may increase and accumulate over time. The potential value of remaining in these indices in terms of long-term shareholding is worth billions of dollars.

REFERENCES

- Durand, R., Paugam L., & Stolowy, H. (2019). Do investors value sustainability indices? Replication, development, and new evidence on CSR visibility. Strategic Management Journal. Find the article on Knowedge@HEC

- Hawn, O., Chatterji, A. K., & Mitchell, W. (2018). Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones Sustainability Index (DJSI). Strategic Management Journal, 39(4), 949-976.