A report about current trends regarding expectations of social impact

In the ESG triad, the “S”, for Social responsibility, seems to attract less attention than the E dimension. Yet it is just as crucial as the two other criteria and inseparable from them as the most recent report by the ESG Club of the Institut Français des Administrateurs, a French Directors' association, points out.

While traditionally, such matters as the ecological transition, human resource management and interaction with the economic ecosystem in general have rather been the domain of the executive managers, board members are more than legitimate to question, challenge and orient leaders especially since the issue is about resilience and the future of the company, in the words of the IFA report. “Boards arbitrate between time horizons and must overcome cycles, as violent as they may be”, write the authors, who have noticed a growing awareness.

The report gives a broad overview of strong trends regarding the expectations of internal and external stakeholders and what these mean for businesses.

What are the precise internal and external expectations regarding the S dimension? How may the board drive change?

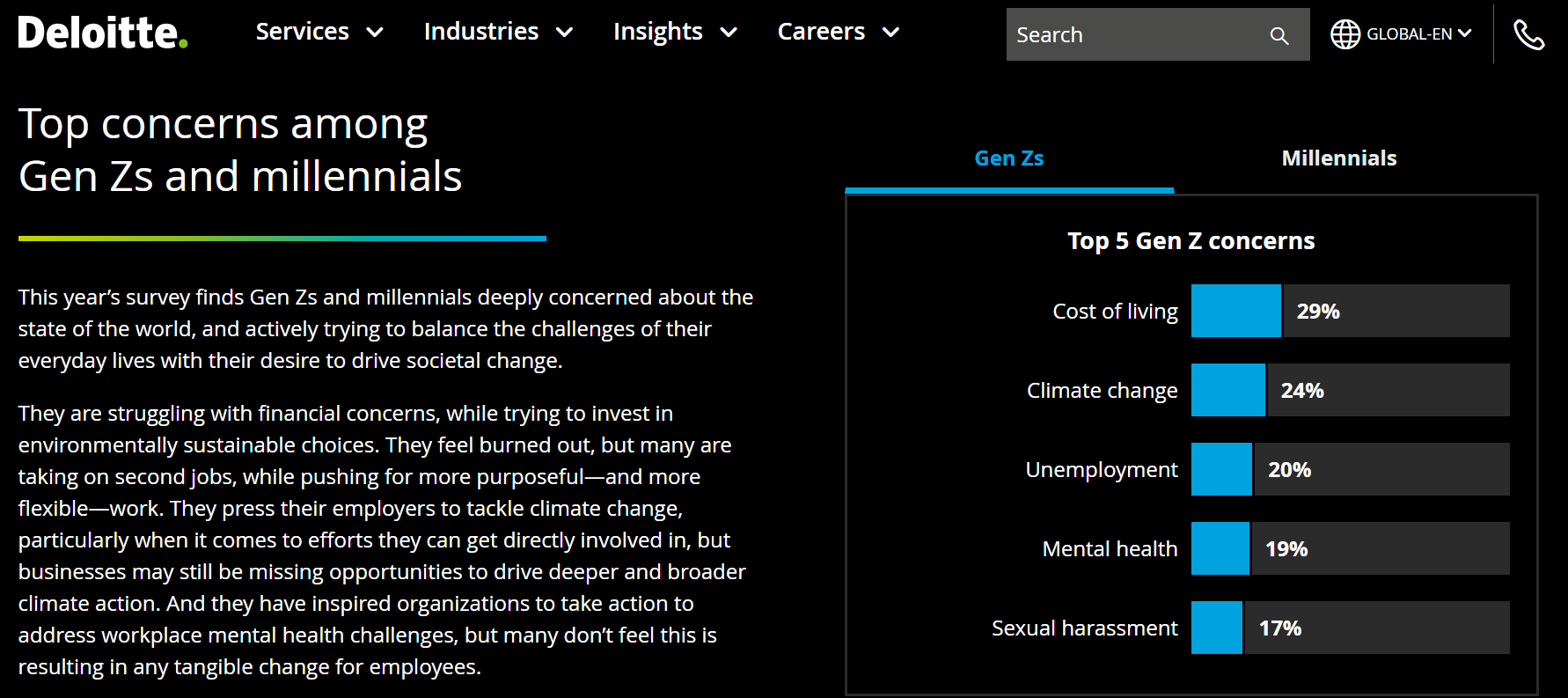

Regarding internal stakeholders, the report details the very high expectations of young people (millennials in particular – those between the ages of 23 and 38) to address climate issues and, a preoccupation shared across all age classes now, find meaning in and at work. Many employees are striving for a good work/life balance, and are eager for hybrid forms of work, with a balance between in-person and at-home work time. They expect companies to offer them the possibility to grow, through for example internal mobility, training, mentoring and efficient talent management.

To truly address all these points, “window dressing” will not do, and “a transparent, motivated and quantified roadmap” is required, warns the report. It sketches out structuring actions in terms of organization, talent management, well-being at work, and so on, with suggestions of initiatives to engage salaried employees in operational projects, identify and retain talents, shift towards new forms of work contracts, and many other ideas.

Deloitte study on the top concerns among Gen Zs and millennials. Learn more in the Deloitte Gen Z and Millennial Survey 2022 here.

Regarding external stakeholders, the report highlights growing pressures. We can mention for example the Duty of Vigilance law (which was voted in France in 2017), and should also be finalized at the EU level quite soon. According to it, companies should be held responsible in case of serious violations of human and environmental rights in their own activities or within their supply chain. Today more and more NGOs and communities sue companies mentioning this duty of care.

At the EU level again, the EU Corporate Sustainability Reporting Directive (CSRD), due to be adopted this year, should require all companies employing more than 250 people to report their social/ societal impact using quite precise criteria: for example on their own social workforce, as well as on the workforce of their supply chain. One of the objectives is for investors to be able to compare performance from one company to another including non-financial performance.

More broadly, inequalities tend to rise due to the pandemic, and the current geopolitical and energetic crisis. And the ecological transition can impact them in a violent manner, as shown during the Yellow Vests movement, which was triggered by the introduction of a new carbon tax.

These rising inequalities tend to fracture our society and lead to growing discontent. This is why it is gradually becoming a necessity to share value more fairly.

Does this mean we are moving away from shareholder capitalism and towards stakeholder capitalism?

Officially, we are moving towards stakeholder capitalism, as reflected by the US Business Round table of 2019, and by the French “Loi Pacte”; but the mindset of many economic actors still remains focused on the shareholders supremacy…

And I do believe that even stakeholder’s capitalism is not enough considering the climate and biodiversity urgency and these rising inequalities. There are trade-offs, companies prioritize some stakeholders, for example investors who are putting pressure, whereas poor workers in Africa, way down the value chain, aren't heard. So today we need companies to lead a deeper transformation, to redefine their purpose and transform themselves, creating a new much more inclusive mindset.

Are business leaders and board members aware of the importance of the S dimension, and do they integrate it in their strategy?

Some business leaders have understood that rising inequalities are not sustainable and not beneficial for their business. They understand that there will not be ecological transition without a social transition. For example, big companies belonging to the Business for Inclusive Growth platform commit to contributing to a ‘Just transition’ - a transition where low-income people also have access to green technologies and where capacity building is proposed to all, to adapt to the new low-carbon world. They also commit to ensuring living wages in their value chain, or at least among their most important suppliers.

Some of them even understand that at one point the S dimension could even become a source of competitive advantage, as all the companies are pushed to integrate the E dimension, claiming a contribution to carbon neutrality. The lack of understanding and anticipation of the S as a systemic risk by many leaders can be a huge risk for them in the medium term, impacting their resilience and competitiveness.

Recommendations for administrators

- Stay informed, get training

The board must set up efficient, durable information circuits to monitor social changes within the company, and relate them to global social trends that may affect the company.

For this, the board may rely on information channels such as the HR department, social media, or direct employee expression, or may invite external experts to board meetings.

- Anticipate and alert

Thus better informed, the board should be able to anticipate and adapt its support to the management team's strategy, in line with the company's mission.

To integrate its business and social strategy, the board must have at its disposal relevant indicators, and a clear operational chart, in order to alert managers if board members believe a course of action needs to be corrected.

- Change

The board must adapt its composition and rules to the company's social ambitions, for example members could rethink their roles and added value.

The board could change membership rules to better reflect the age, expertise, geographical make-up of the company as a whole, and work in a collaborative spirit to display an inspiring, inclusive leadership.