Political science research shows that people stick to a political identity that solidifies in early adulthood and that acts as a perceptual filter through which they interpret the world. Numerous researchers have taken this hypothesis to the data and confirmed its validity.

For instance, Americans who identify themselves as Democrats tend to assess the economic conditions of the U.S. positively when the president is a Democrat and negatively when the president is a Republican. Conversely, those who identify as Republicans do the opposite.

What is particularly striking is that people with different political affiliations make opposite assessments of economic conditions prospectively - when a new president comes in - but also retrospectively, after the presidency has ended. In other words, people disagree not only in their predictions but also in their evaluations of the facts.

When Financial decisions are influenced by political affiliation

You might think, “OK, people disagree when it comes to arguing about politics, but when it comes to making decisions with important financial implications, political affiliation remains at bay.”

However, this is not what the data reveal. After Trump’s 2016 election, Republican households increased their investments in the U.S. stock market. Meeuwis et al. (2022) attribute this behavior to Republicans interpreting Trump’s election as good news for the U.S. economy, making them more eager to invest in stocks. In contrast,Democrats followed the opposite reasoning and refrained from buying stocks.

In a nutshell, people allow their political affiliations to influence their financial decisions.

Finance professionals fall to their political beliefs too

What is even more surprising is that finance professionals fall to their political affiliation too. Credit analysts give lower ratings to U.S. corporations when the U.S. administration is not aligned with their political affiliation. Kempf and Tsoutsoura (2021) show that the same company initially rated BBB by two credit rating agencies is likely to be downgraded by a rating agency whose lead credit analyst covering the company is a Democrat. On the contrary, another rating agency whose lead credit analyst covering the company is a Republican does change its rating on average.

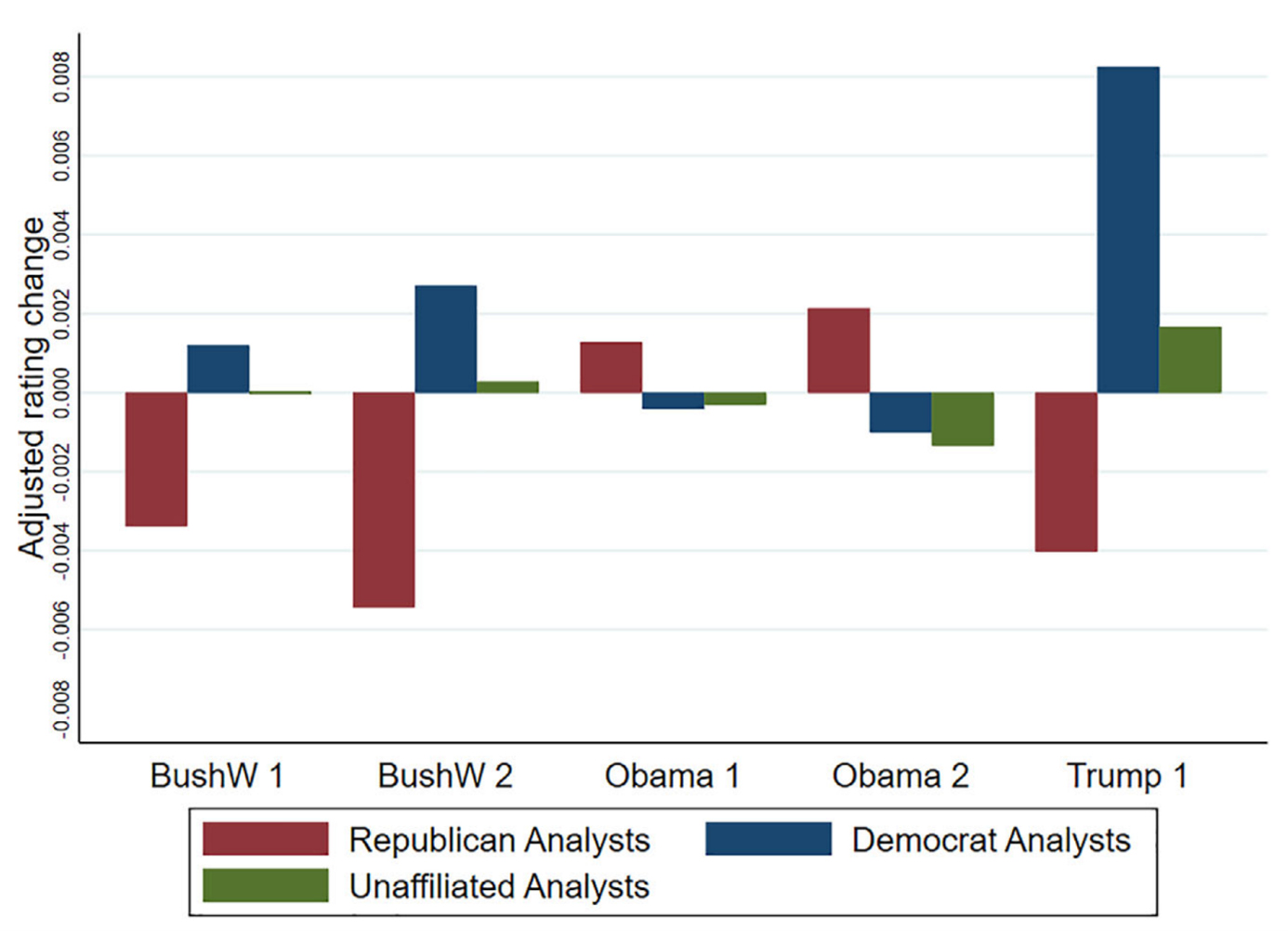

The figure below illustrates this phenomenon. During Republican presidencies (Bush W. and Trump), Democrat analysts tend to downgrade U.S. companies’ ratings (with lower ratings coded as higher values on the graph). Conversely, during Obama’s presidency, Republican analysts downgrade ratings. This effect is larger during Trump’s presidency – arguably the most polarizing one.

This phenomenon extends to investment flows. Kempf et al. (2023) show that international mutual funds are more likely to invest in countries whose government align with the political views of the fund manager. In the same vein, a number of U.S. banks make – and are required to disclose – political contributions. This information can be used to assign a political affiliation to these banks. Kempf et al. (2023) demonstrate that U.S. banks are more likely to invest in countries with governments that align with the political affiliations revealed by their political contributions.

Now, ask yourself how your economic choices are affected by your political views.

Sources:

Kempf, Luo, Schäfer, and Tsoutsoura, 2023, "Political Ideology and International Capital Allocation," Journal of Financial Economics.

Kempf and Tsoutsoura, 2021, "Partisan Professionals: Evidence from Credit Rating Analysts," Journal of Finance.

Meeuwis, Parker, Schoar, and Simester, 2022, "Belief Disagreement and Portfolio Choice," Journal of Finance.