Global Value Chains (GVCs) encompass a series of linked processes and transactions that divide and share production across different companies and countries. Your lunchtime ready meal may feature vegetables grown in Chile, cheese from France, and packaging manufactured in China, all put together by a local distributor.

GVCs are a major source of prosperity and employment, contributing to 60% of world trade and directly employing around 453 million people. Since the introduction of the World Trade Organization in 1995, GVC trade has skyrocketed. However, participation in GVCs requires difficult economic preparation and internal reforms. Trade conflicts and climate change add to the challenges, and recent disruption of supply chains has led to lower productivity and lower incomes.

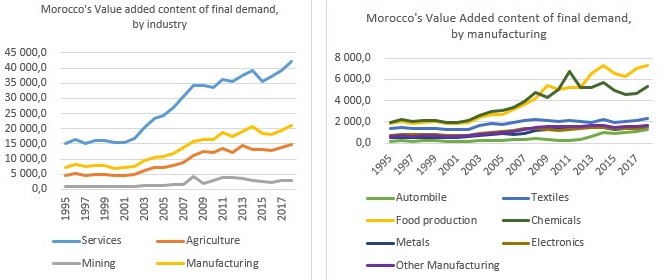

For Morocco, improving its integration with GVCs is both complex and full of potential as it transforms from an agricultural economy to one that includes value-adding activities like workforce training and technology. For us in Europe, a growth in the GVCs of countries such as Morocco would reduce our reliance on Chinese and Taiwanese capacities (such as solar panels and electronic chips), and Indian strengths (such as generic drugs).

Studying GVCs across four very different industries in Morocco helps identify that creative human capital, participatory governance, technology, water, and energy are the key components of a more sustainable and inclusive GVC integration strategy.

Morocco: a kingdom of opportunities

The Kingdom of Morocco is one of the world’s GVC success stories, with a proven integration model and a pattern of continuous improvement. It is more competitive in this respect than many African countries, and its model has been recognized as an effective one by various international institutions.

The integration model is part of King Mohammed VI’s vision – a policy based on developing sustainable and innovative industry, modern infrastructure, and competitive, government-led industrial ecosystems. It brings with it a new generation of government-multinational firms. Contributing to its success are its strategic location – just 14 km from Europe – its political stability, and modern infrastructure such as its high-speed train and Tanger Med port.

We set out to explore the challenges, successes, and opportunities of Morocco’s GVC integration model using four industry cases – phosphate, automotive, textile and agribusiness.

Phosphates: from rock to plate

Morocco is the world’s leading producer and exporter of phosphates, holding more than 70% of the world’s reserves. Thanks to the state-owned OCP Group, Morocco has succeeded in controlling the downstream value chain by transforming extracted rock into fertilizers. As one of the world’s largest fertilizer producers, it is able to increase global agricultural productivity and contribute to reducing hunger.

Like other mining groups internationally, OCP Group must contend with a strict regulatory environment. However, its ability to meet these challenges is buoyed by its strength across every aspect of the value chain from mining to the marketing of finished products, and its growing authority in R&D for phosphates and fertilizer products.

Adapting the automotive sector to meet emission standards

The automotive industry is the Kingdom’s largest export sector and one of its major growth engines. It is currently undergoing a profound transformation of its organization and products, as is the global automotive sector. The transition to 100% electric vehicles is part of this picture, as is the rise of mobility services – where transportation, rather than vehicles, is what the customer buys or rents.

Morocco’s challenge is to master the technology required to develop and manufacture electric vehicles, and to train its workforce accordingly. It must also attract industrial investors who will provide the high levels of capital required by automotive production.

Building sustainable and resilient agri-food systems

Agribusiness is a perfect illustration of the opportunities available in GVCs, with agricultural actors able to control the downstream industrial transformation of products, such as canned items, ready-made meals, and frozen foods. But the rich agricultural and natural resource potential of Morocco has yet to be fully realised. There is not yet a renewable energy sector and there is more work to be done to improve food and energy independence.

The industry’s challenge is to localize the industrial processing of agricultural product to add value. Although these activities exist, they are currently carried out by certain isolated and specialized sectors rather than across the industry.

Redefining the textile industry around Morocco’s strengths

The textile industry represents 1,600 companies and directly employs around 190,000 people, but it has been negatively affected by competition from Chinese businesses over the past 20 years. A new generation of companies focused on innovation and rigor are working to improve the Kingdom’s supply-chain integration by manufacturing finished clothing and fabrics.

Morocco’s proximity to the European market, know-how in fast fashion, and free trade agreement with Turkey all represent strengths. The textile industry must invest in human capital and R&D while navigating the inherent challenges of price sensitivity (the degree to which a product’s price affects how likely it is to be purchased) and elasticity of demand. It has potential to grow its textile sector around authentic and traditional “made in Morocco”

selling points. A key challenge is to recover value-added activities in its negotiations with Spanish, Swedish and Japanese contractors who dominate the sector.

Challenges and opportunities for Morocco

Our analysis shows that mobilizing international and national actors around a long-term Royal vision has been favorable in Morocco’s case. Strategic government, responsiveness, diversity of clients and suppliers, national solidarity, and industrial collaboration made it resilient and innovative during the pandemic period.

However, Morocco’s participation in some GVCs is characterized by low added value, low upgrading, lack of innovation, few jobs for young people, and strong dependence on environmental conditions and on the European market.

The country must be vigilant about the quality of the GVC projects presented to it and wary of players that are only attracted by the tax system. Trusted foreign partners could bring new technology and markets to the country, but some priority should be given to domestic entrepreneurial investors to limit risks. It is also vital that Morocco creates sustainable value while respecting the environment and the welfare of its people.

With the necessary infrastructure, logistics, and workforce, Morocco could take better advantage of the European market. It could play a growing role as a platform for a pan-African approach to development and support other countries such as Algeria, Tunisia, Libya to develop their GVCs to grow prosperity and employment.

| Challenges | Objectives | Actions |

|---|---|---|

| The challenge of governance |

Moving from a vision of program contracts to a shared vision, supported by participatory partnership governance. Broaden the current participation framework to the different stakeholders: Government - Firms - Local SMEs - Civil Society. Open to NGOs and the local private sector. |

Establish a permanent and constructive dialogue and proactive communication with stakeholders. Identify the new positioning of Morocco in the different GVCs and their operating models (targeting, choice of GVC and suppliers). |

| The challenge of shared value |

Certain growth potential requires better integration of social and environmental dimensions (transforming societal threats into opportunities). Offer additional sustainable products and services. Act on social acceptability. Favoring projects that create jobs and have a reasonable level of investment. |

Guarantee its partners products and services with the best quality/price ratio to ensure maximum well-being with the most efficient use of local resources. Create a differentiated offer based on the specific resources of the territories where GVCs are established in Morocco. Develop an offer to help SMEs growth (financing, mentoring, marketing, acceleration, certification, etc.). Set up a financing system adapted to the GVCs (business model and financing products). Large continuous efforts to invest in education and training. |

| The challenge of innovation |

Thorough consideration of the 4th industrial revolution and automatization policy. Propose a Moroccan GVC process, bringing innovation and high quality closer together. Reflect on tomorrow’s challenges: industrial, social, and environmental deliveries. |

New innovative localized production sites Constant emulation through a dynamic challenge linking high tech and low-tech sectors, industrial production, and automatization, circular economy, and environmental and social sustainability. |

a research co-led by OCP Foundation, Université Mohammed VI Polytechnique and HEC Paris

“On behalf of the OCP Foundation, I would like to express my deep gratitude to HEC Paris and the Université Mohammed VI Polytechnique - UM6P for their trust during these two years of training and research. Together, we developed an outstanding research project for policymakers and entrepreneurs, exploring sustainable global value chains.

This successful collaboration between the largest Moroccan company and HEC Paris has resulted in significant results, highlighting Morocco’s emergence within four global value chains. Working alongside Professor Bertrand Quélin has been rewarding, and we hope to continue this collaboration by establishing an analysis laboratory dedicated to global value chains, thus strengthening the links between Europe and Africa.”

Abdelmonim Amachraa, OCP Foundation