Handling new tasks in a different function* is attractive because it brings broader knowledge and better understanding of the business. Cross-functional transitions force us to deal with unusual situations and new audiences and train us to see a problem from multiple perspectives, so that we can make better decisions in future. But at the same time, they pose a significant challenge because skills that make us successful in the current job might not be relevant in a new function. Broadly speaking, experience in multiple functions may make us well-rounded individuals but also leave us dilettantes in every field that we have tried.

Should we specialize or diversify to boost our career?

To answer this question, we need to understand what knowledge and skills one acquires and loses by engaging in cross-functional rotations and what knowledge and skills are needed to perform high level jobs. Importantly, managerial skills are multidimensional: some of them depend on the function, such as domain expertise, while others are universal, such as negotiation skills or strategic thinking. To disentangle those different components, we look at two dimensions of the managerial experience: in different functions and in different managerial roles.

Experience in multiple functions improves one’s chances to reach higher organizational levels but might be not as beneficial earlier in one’s career.

From functional perspective, we found that experience in multiple functions improves one’s chances to reach higher organizational levels but might be not as beneficial earlier in one’s career. Because job complexity increases with hierarchal level, domain expertise becomes less useful at more senior levels, while the need for broader knowledge and more general skills increases. Accumulating various work experiences stimulates integrative complexity, the ability to consider and combine multiple perspectives, and improves strategic thinking, a critical competence for senior managers. However, for lower-level managers, who mostly engage in operational rather than strategic tasks, it makes more sense to specialize to deepen domain expertise, which helps managers to faster identify task-specific problems and find better solutions within their area of expertise.

The question is even trickier for managerial roles

First, let’s define what is a managerial role. A managerial role is a predictable set of behaviors one can observe in daily activities and associated with a particular managerial position in an organization. In other words, it is a way of managing. A manager has three major ways of managing related to action, people, and information. Let me explain.

1) Action:

In the first way, the necessary action is performed by the direct involvement of a manager. It represents a “doer” role, which includes supervising projects, solving problems, making decisions, and negotiating deals.

2) People:

The second way implies managing indirectly by encouraging people to take necessary action. It is a “leader” role, which involves motivating and developing people, building teams, maintaining culture, and creating useful connections.

3) Information:

The third way is even less direct: a manager collects, processes, and shares information, but also controls information flows to influence people and ensure that they take necessary action. It is an “administrator” role, which might be exercised by creating systems, designing structures, implementing procedures, or imposing directives.

Although managers might have a large repertoire of roles, they tend to gravitate towards one of these types. Notably, dominant managerial roles vary across functions and hierarchical levels. Therefore, by moving cross-functionally, one may acquire experiences in either similar or different managerial roles, and these experiences may be either beneficial or harmful for potential promotion.

We found that at the lower managerial levels, dominant managerial roles are people focused. At the higher levels, the focus shifts from managing people to direct action, while information processing is useful at all levels. These findings suggest that managers with “doer” profiles are more likely to achieve higher organizational ranks than those whose experience is concentrated in interpersonal interactions.

Managers with “doer” profiles are more likely to achieve higher organizational ranks than those whose experience is concentrated in interpersonal interactions.

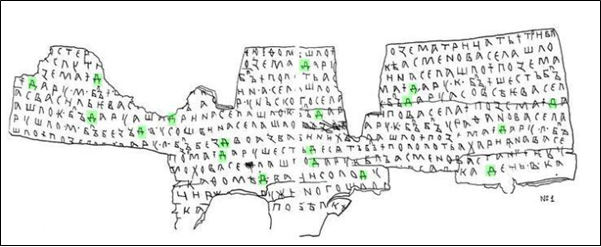

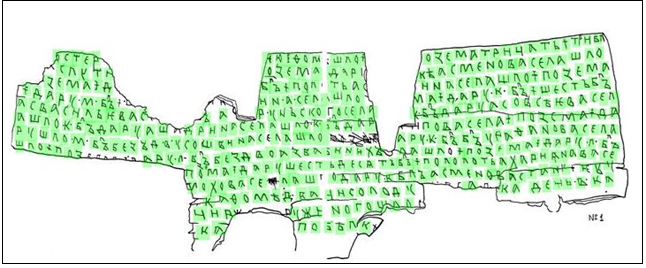

Methodology

We studied organizational career histories of 422 managers in a large pharmaceutical company. We collected data on all their job transitions within the company and studied job descriptions to better understand their roles in every appointment. We classify each job in three dimensions: the functional affiliation, the managerial role, and the hierarchical grade. While functional affiliation and hierarchical grade are clearly stated in the company’s HR records and aligned with its job catalogue, managerial roles are more subtle. So we had to carefully study the job descriptions to determine what types of activities a manager performs in a particular job and to infer what role(s) he or she plays. Based on this data we calculated the level of functional specialization of each manager and statistically tested how it influences one’s chances to be promoted from lower to middle management and from middle to senior management. We also looked at managers’ experience in different types of managerial roles and identified what roles are most valuable at different managerial levels.

Interview with Knowledge@HEC

Based on these results, what do you recommend to someone developing a managerial career and interested in achieving higher organizational ranks?

First, build a solid foundation in one function, but when you reach the middle management rank, think about expanding your experience outside of your areas of expertise.

When planning a cross-functional move, think about what the dominant managerial role in a new function would be. It might sound counter-intuitive, but the more your experience is concentrated in “doer” and “administrator” roles and less in “leader” roles, the more skills necessary for higher-level jobs you will develop.

What do these results mean for organizations that think about developing their future leaders through cross-functional job rotations?

Not every cross-functional move is beneficial. The best leaders grow out of specializing generalists, those who develop broad knowledge and cognitive complexity though experience in multiple functions but keep concentrating in managerial roles most valuable at higher organizational levels. Therefore, paying close attention to managerial roles when developing a job rotation program is an essential condition for its success.

The best leaders grow out of specializing generalists.

*Function means functional unit in an organization: Sales, Marketing, Finance, IT, etc. Each function is associated with different tasks and requires different skillsets. Diverse experience means experience that spans multiple functional units.