In the wake of the 2008-9 global financial crisis, the stability of derivatives markets has been brought into question, leading to regulatory reform. In these markets, hundreds of trillions of dollars were previously traded bilaterally in over-the-counter transactions with little regulation or control. “Derivative markets are based on long-term commitments,” explains Guillaume Vuillemey. “Counterparties agree to complete a trade in the future – maybe 10 years from now – but there is a risk that one party could default in the meantime making the commitment worthless”. In an attempt to reduce this counterparty risk, regulators worldwide have put mandates in place to safeguard trades through central clearing.

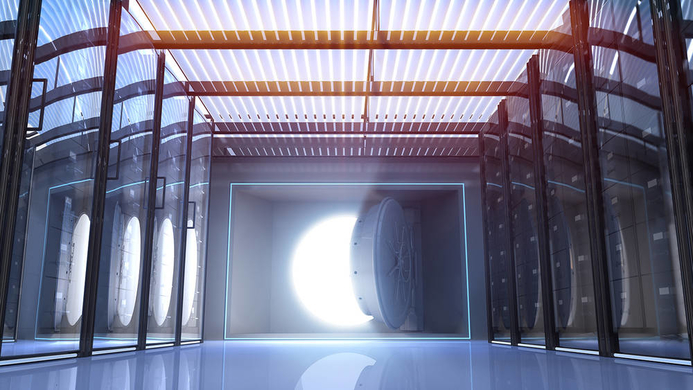

Central clearing parties: counterparty to every trade

Central clearing parties are private institutions set up to mediate counterparty risk. Parties that trade standardized derivative contracts in the bilateral market go through central clearing parties to ensure all long-term contracts will be executed. A central clearing party thus become counterparty to every trade: essentially a buyer to every seller, and a seller to every buyer. “And what if these central clearing parties default?” asks Vuillemey. “This would be very dramatic as the centralization of all trades with these clearing parties exposes them to trillions of derivatives trades made by all banks and other financial institutions in the market”.

Collateral demand of central clearing parties

One way central clearing parties can manage this risk is to call collateral from the parties involved in the trade. They store this, keeping it as a buffer to enable the future trade to go through, even if something goes wrong and one of the parties defaults before the trade is due. Creating these buffering reserves of collateral removes it from the market, which sparked debate within the financial community. They saw a trade-off between the enhanced financial stability offered by central clearing, and the cost of the possible collateral shortages that this may cause. This led to the question, with more stringent collateral requirements, would banks be able to preserve sufficient lending? In turn, how large will the cost of financial security be?

Conditional on having the new requirements on bilateral trades, central clearing does not lead to increased margins.

A unique dataset

Vuillemey and co-workers had unique access to confidential data about bilateral derivative exposures worldwide. They used this real data in a simple model that enabled them to measure how much collateral is needed to safely clear derivatives in the market. It also enables determination of how estimates change with changes in market structure. “Suppose that we are trading today: I commit to sell you something in the future,” he explains. “The value of this contract changes on a daily basis, and we soon find out if it was bought at a good or bad price.

It then becomes an asset for you and a liability for me, or vice versa”. He adds, “The model says that the amount of collateral that has to be posted depends on how large a liability the contract is for me or for you, and on the volatility of its market value”. Initially, the model shows how much collateral is needed in the bilateral network before the regulatory reforms were put in place. It is then possible to determine how much collateral needs to be posted if there is a central clearing party involved. The number of these clearing parties can be altered and the effects on collateral requirements observed.

Bilateral or centrally cleared trades?

The financial reform did not prohibit traditional over-the-counter bilateral transactions. Instead, these can coexist alongside central clearing parties but are subject to higher requirements that are now in place to push trades towards going through central clearing. Vuillemey’s results show that, conditional on having the new requirements on bilateral trades, central clearing does not lead to increased margins. Although the total collateral demanded does increase, the hypothesized collateral shortage does not necessarily follow. “When new trades are cleared, collateral requirements will initially increase,” explains Vuillemey. “But if everything in the market is cleared, requirements go down and clearing become less costly”.

Financial stability and cost reduction are achievable

Vuillemey provides the following example: “For a trader with a diversified portfolio containing many types of derivatives that all go through central clearing, more collateral will be required and they will receive the benefits associated with diversification of trades. In addition, there will be netting benefits; as a buyer and seller with many different counterparties, having both long and short commitments, all of this can be netted out by the trader when going through the central clearing party. Resultantly, the collateral requirement for the trader will be lower, not higher”.

Vuillemey thus condemns the idea that to reduce costs, only a proportion of transactions should go through central clearing. He concludes, “The real benefits of financial stability and reduction of costs can only be achieved when the majority of trades go through.