Key Ideas

• When a company transfers or sells just a portion of its assets, market response is very positive when the assets are paid for in equity, and decidedly less so when they are paid for in cash.

• Incases of mergers or acquisitions, the opposite is true.

• Market reactions vary depending on who defines how the transaction will be paid for and the information thus revealed.

How to buy a company

When it comes to acquiring a company, in part or in full, buyers can pay in cash or in equity. According to Hege and Lovo, approximately half of today’s acquisitions are paid for with equity. Companies being purchased are sometimes so big that it would be impossible to pay cash without creating an explosive level of net debt. Buyers therefore pay for the company by issuing shares and thus avoid upsetting their financial balance. But there is another reason for paying with equity. Financial theory shows that the method of payment chosen sends useful information to the market and enables the initiator of the transaction to maximize value.

Full acquisitions: payment methods and markets reactions

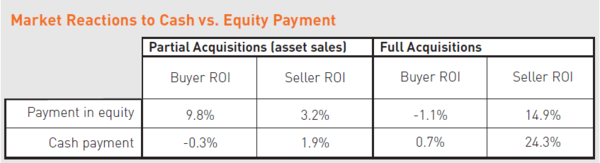

Numerous empirical studies evaluate the market impact of the payment method used (cash vs. equity) for full-company acquisitions. Research results (see table) consistently demonstrate the following:

• The market reacts positively to the seller, regardless of the method of payment.

• The market reacts positively to the buyer when the transaction is conducted in cash, but negatively when the purchase is made with equity. In fact, payment choices reveal private information that the market uses to assess share value. When buyers consider their stock to be overvalued, they prefer to pay with equity. They should therefore pay cash to win the trust of investors.

Partial acquisitions: a different story

No matter what the type of acquisition (partial or full), both buyers and sellers possess only asymmetrical information. Sellers have information about the value of what they are selling, while buyers are knowledgeable about potential synergies from the acquisition. Still, the researchers have found that when acquisitions are only partial, the market reacts differently to the two means of payment. In this case, assets purchased with equity present greater relative gains than those paid for with cash (see table).

Payment initiator and share value

According to the researchers, market reactions to partial vs. full acquisitions vary depending on which of the two parties (buyer or seller) initiates the transaction, and on the signals this choice sends.

• Full acquisitions: The buyer must make a formal offer, which requires shareholder approval. It is therefore the buyer who makes the final offer and at this point proposes a cash or equity payment. The means of payment sends a signal to the market.

• Partial acquisitions: In this case, shareholder approval is not required. The seller conducts an auction, which forces potential buyers to release information. In the second case, the seller’s acceptance or refusal of payment in equity sends a signal to the market about the quality of the transaction. A seller that accepts to be paid in equity sends a positive signal, whereas a preference for a cash payment indicates doubts about the soundness of the transaction. Indeed, sellers that believe that the assets transferred will create value for the buyer prefer to be paid in equity, as this means of payment implies retaining shares in the buyer’s company.