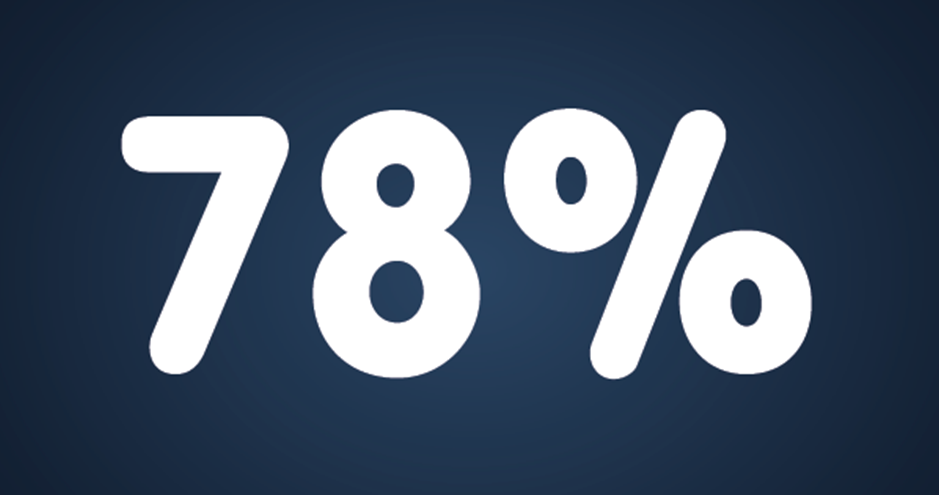

78% of employees live paycheck to paycheck

For many employees, setting aside some money each month is far from straightforward. One statistic reveals exactly how widespread this problem is - according to research by CareerBuilder, 78% of employees in the U.S. are living paycheck to paycheck. The study also found that more than one in four workers do not set aside savings each month and nearly three in four say they are in debt. Perhaps most surprisingly, one in 10 workers who earn more than $100,000 per year still end up living from paycheck to paycheck.

The health impact

As you might imagine, living with the financial strain of fully relying on each paycheck for support can have a significant impact on your health. The American Psychological Association cites money as one of the top causes of stress for Americans. A 2014 study found that 20% of Americans put their healthcare needs on hold because they can’t afford to pay the bills. An Australian study found that stress can cause people to smoke, which in turn increases the likelihood of heart disease and other health issues.

Financial difficulties can also threaten our mental health. One study from Social Indicators Research found a connection between financial security and the ability to find meaning in life. Financial stress is linked to a reduced sense of purpose, which can then lead to mental health issues such as depression.

What you can do…

The good news is that there are a few strategies you can implement to overcome financial difficulties. One option, recommended by Forbes, is to start an emergency fund. This may not be feasible for everyone, but if you can manage to save early on, it may allow you more financial flexibility in the future. Emergencies like the recent government shutdown in the U.S., when more than 800,000 employees did not receive paychecks, can happen at any time. Ideally, your emergency fund should be in a separate account and have about six to nine months of salary to cover unexpected expenses.

Forbes also suggests starting a side job to help you pay off your bills and save funds. This comes with an added bonus - you never know when a part-time gig could end up turning into a full-time job. Another option is to consolidate your credit card debt into a personal loan. Doing so allows you to reduce your interest payments, and the savings can then be used to pay off debts or start an emergency fund.

Knowing how economic stress can impact our health – and understanding the resources for combating it – can help us look to a future with less debt, less living paycheck to paycheck, and a greater degree of financial flexibility.