Finance: A Panoramic View for Executives

Cannot see the finance forest for the trees? In this article, we explore and organize some of the fundamental concepts of finance alongside Ioanid Rosu, the academic director of the Executive MSc in Finance at HEC Executive Education. The program provides a hands-on approach to major financial concepts and their application, and it serves as a go-to source of advanced knowledge for high-level finance professionals. Here's a panoramic view of what you should know about financing, investing, valuation and hedging.

1. Financing: The Lifeblood of Business

Imagine every successful entrepreneur, from Bill Gates to Elon Musk. They all needed funding to transform their ideas into thriving corporations. Financing, typically achieved through debt and equity, is the first step in the corporate finance journey. It involves securing capital for business operations, expansions, and innovations.

Understanding Equity

Also known as share capital, shareholder’s equity is the value of assets net of liabilities. It provides dividends and the potential for capital gains. Equity holders may also enjoy voting rights in company decisions.

Debt Financing

Debt, in the form of bank loans or corporate bonds, is a common financing method. It involves repaying the loan amount and making interest payments. Failure to meet these obligations can lead to bankruptcy and the reorganization or liquidation of a company. In liquidation, the hierarchy of payouts starts with secured debt, followed by unsecured debt, preferred equity, and finally, common equity. Debt is generally less risky than equity since it is paid first during bankruptcy.

Equity vs Debt

Equity offers flexibility in terms of payments, but it dilutes ownership. Equity also suffers from what economists call asymmetric information problems: If a manager issues new equity, it is likely that the manager thinks equity is overpriced. As the manager knows more about the company than the markets, equity issuing can be a bad signal to markets and lead to lower equity prices. Debt, on the other hand, suffers less from asymmetric information problems and offers significant tax benefits, but can lead to bankruptcy if payments are missed.

2. Investing: Balancing Risk and Return

Investors represent the other side of the financing process, playing a crucial role. They evaluate risk and return before providing funds and compete to maximize return while avoiding risk. Investors’ perspectives shape the financial landscape and help select worthy entrepreneurs.

In the realm of finance, understanding the intricacies of investing is an essential skill for every manager and specialist.

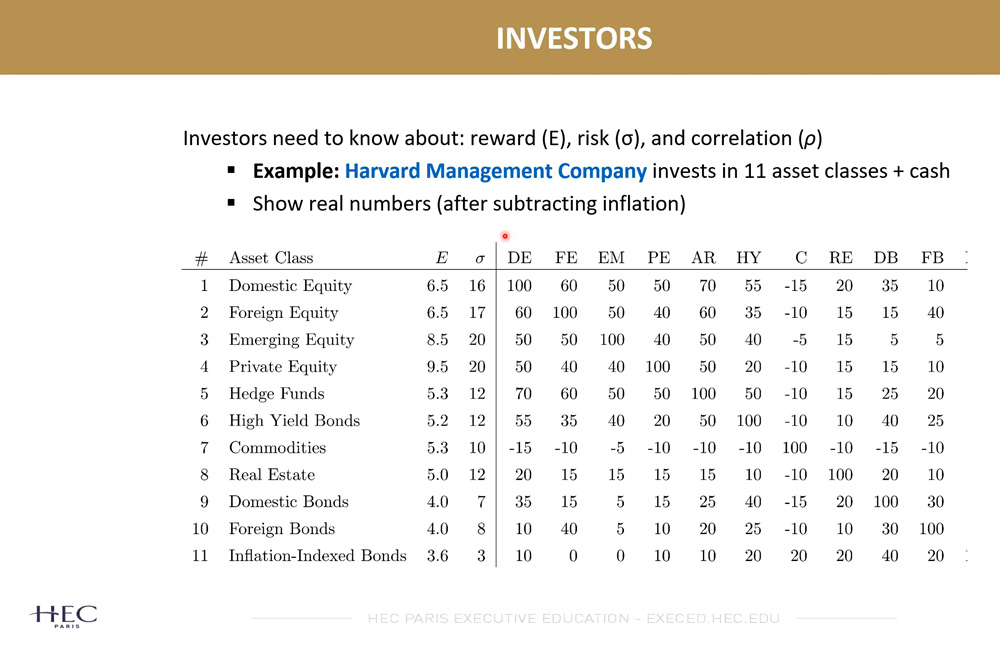

The Harvard Approach

Harvard Management Company is the key drive behind Harvard University’s stellar financial performance, managing an endowment currently estimated at $53.2 billion! Its investment prowess lies in its diversification strategy.

Modern Portfolio Theory

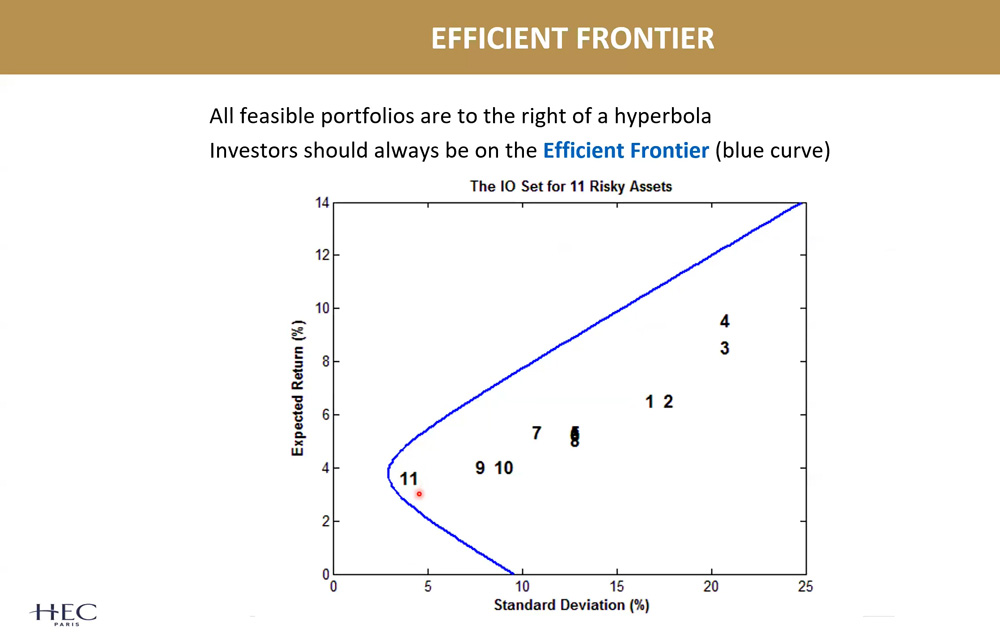

A critical tool in generating optimal investment strategies is Modern Portfolio Theory (MPT), started by Nobel prize winner Harry Markowitz in the 1950s. This model quantifies the tradeoff between risk and return, and it shows how to minimize risk for a given level of expected return.

The portfolios an investor can generate correspond to the region to the right of the blue curve in the figure (geometrically called a “hyperbola”). Investors should aim to be on the boundary of that region, the Efficient Frontier. This boundary achieves maximum diversification of investments: “Don’t put all your eggs into one basket!”

The Capital Asset Pricing Model

Expected return is a key concept in finance. It is the investor's reward for taking on risk. The higher the risk, the greater the expected return. But the risk of a financial asset cannot be judged in isolation, by simply looking at its volatility. Instead, investors should consider the asset’s beta (or cyclicality), which measures how the asset affects the risk of the rest of the portfolio. According to the Capital Asset Pricing Model (CAPM), which was developed in the 1960s by another Nobel prize winner, Bill Sharpe, the expected return of any asset should be increasingly dependent on the asset’s beta. Intuitively, a stock with low beta provides insurance against a market downturn and is so desired by investors that they are willing to tolerate a lower reward (expected return) on the stock.

3. Valuation: Pricing Projects and Companies

Valuation, with a focus on discounting future cash flows, is another cornerstone of finance. Understanding how risky projects, assets, investments, and even entire companies are valued is essential for making informed financial decisions.

Present Value

At its core, valuation revolves around the concept of present value. In modern finance, this means discounting future cash flows so that they can be compared to the present cash flows.

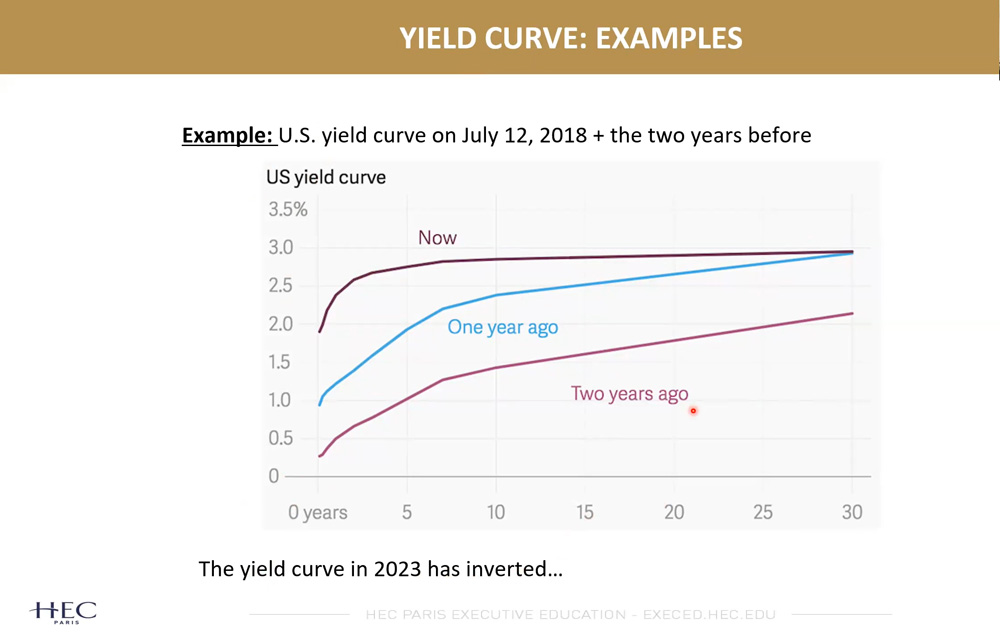

Valuing Bonds

When it comes to bonds, their prices satisfy a Present Value formula with different discount rates at different future horizons. These discount rates form what we call the "yield curve." The yield curve is not just a static representation; it's a powerful tool for forecasting the future. For instance, when the U.S. yield curve becomes inverted (downward-sloping), it is a strong indicator of an impending recession, as it proved to be in the past seven economic recessions in the U.S.

Valuing Stocks

Valuing stocks is more complex. Unlike bonds, stocks don't offer a fixed payout. Instead, stock valuation relies on expected future cash flows. In corporate finance, professionals analyze cash flow projections and divide them by a discount rate. Generally, the same discount rate is used for stocks, and it is equal to the expected return. Thus, the discount rate is often derived from an asset pricing model like the CAPM.

Weighted-Average Cost of Capital

For companies, determining the correct discount rate is crucial. It must reflect the reward investors expect for investing in the company. This benchmark rate is known as the Weighted-Average Cost of Capital (WACC). It considers the company's cost of debt and equity and their respective weights in the capital structure.

4. Hedging: Mitigating Risk While Seeking Profits

Hedging aims to protect investments from the unpredictability of the markets, while still aiming for profits. Risk management is another name for hedging when done at the company level.

Hedging is a widespread practice, employed by various market players, including individual investors, corporations, pension funds, insurance companies, mutual funds, market makers, and hedge funds. There are various ways these players approach hedging.

• Pooling involves consolidating assets like mortgages to create securities that generate predictable cash flows and reduce risk.

• Derivatives (futures, options, swaps) are instruments that depend on the performance of other assets. For instance, a call option allows you to profit when a stock rises above a threshold without the risk of losing money if the stock falls below the threshold. The derivatives may appear cheap and can reduce risk when combined with other securities. However, they can also amplify risk to extremely high levels.

The famous American investor Warren Buffett once described derivatives as “financial weapons of mass destruction”.

• Arbitrage is a fundamental concept in finance, as it aims to correct price discrepancies in different markets. Arbitrage is all about "buying cheap and selling high": It involves buying a cheap asset and short-selling an expensive version of an asset with near-identical risk properties (short-selling means borrowing an asset to sell it right away).

The Rational "Irrationality"

If market players are good at predicting future prices, this has two implications: the best estimate of tomorrow's price is today's price, and the price change between today and tomorrow is entirely unpredictable. This makes market prices appear volatile and irrational. However, there's a method to this madness: randomness is simply the consequence of market efficiency and not proof of irrationality.

Risk Managers and Insurance Writers

Hedge fund managers wear multiple hats. While they engage in risk management, they also write "catastrophe insurance" to markets. They attract investments by insuring against unlikely market "fires" and aim for consistent small gains while facing rare large losses. The risk of hedge funds is only small in calm markets. Once markets start falling, hedge funds turn out to be no longer hedged and they may blow up. But if the “catastrophe insurance” is expensive enough, the business of hedge funds may still be profitable.

Financial Innovation

Some players opt to reduce risk by gaining access to faster, more precise information. Others provide liquidity through market-making activities, facilitating smoother market operations. The drive to hedge risk is the impetus behind much of the creation of new and more complex financial securities.

Ready to elevate your career and enhance your financial expertise? Whether you're looking to sharpen your financial and quantitative skills, pivot to a new career, or excel in corporate leadership, the Executive MSc in Finance program is your gateway to success. Explore unique opportunities to gain profound insights into advanced finance concepts and secure your future in finance.

Join us today to embark on this transformative executive journey.